Performance

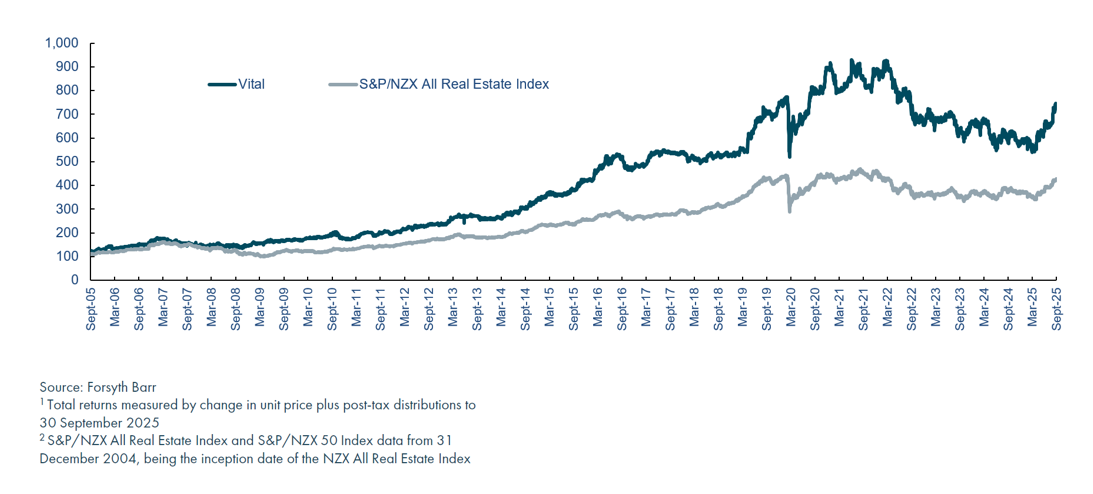

We are focused on delivering earnings growth for our Unit Holders and are targeting AFFO growth of 2-3% per unit per annum over the medium term. Earnings growth is expected to support both a steady increase in distributions to Unit Holders and unit price appreciation over time. A combination of earnings growth, distribution growth and unit price appreciation is expected to enable us to continue to outperform the NZX property index on a total return basis into the future.